Content

The business needs to be able to cover all expenses and expected outlays. This includes staff, stock, bills, insurance, rates, and rent etc. If you want to know more about business structures, how they operate, and how to choose them, read our article here. Dividends are taxed as personal income, which can reduce the overall return for shareholders. Dividends can serve as a signal to the market of the company’s financial stability and future prospects.

- However, the amount withdrawn must be reasonable and should consider all aspects of business finance.

- Business taxes are nothing but the taxes that your business must pay as a part of its business operations.

- It’s not easy, but many small business owners find themselves in this situation.

- Therefore, no income taxes, Social Security, or Medicare comes out of your check.

- This means they get taxed twice–the corporation pays a 21% corporate tax on the profits and the shareholders pay tax on it at their personal tax rates–as high as 37%.

- In the case of an LLC or a corporation, the owner’s equity may be termed as shareholders’ equity or stockholders’ equity.

- A sole proprietor, partner, or an LLC owner can legally draw as much as he wants for the owner’s equity.

For example, if Susan’s hair salon is a partnership, she’s not able to collect a salary paycheck because according to the IRS, you cannot be a partner and an employee. Be honest about how much it will cost to run the business without interruptions or cash flow problems. Make sure to include emergencies or seasonal expenses that may come up. Drawing too much and leaving the business vulnerable to cash flow issues will hamper growth and cause unneeded stress.

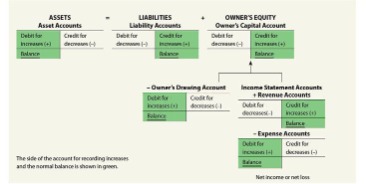

What is Owner’s Equity?

So, to determine how much to pay yourself, you also need to go through your P&L. Generally, reasonable pay is the amount that a similar business would pay for the same or similar set of services. Your small business earnings are a reflection of the hard work that you had put in to bring your business to life. Kelly is an SMB Editor specializing How To Pay Yourself As A Business Owner in starting and marketing new ventures. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University.

In a partnership, unlike a sole proprietorship, there is more than one owner. However, like a sole proprietorship, it’s also a pass-through entity, and thus all profits will be passed through to the partners. Partners are not employees paid a salary, but they do pay themselves with an owner’s distribution. Instead, they wait until the company is more secure and they better understand how finances ebb and flow. It’s important to note that once a business owner starts paying themselves, the expense needs to be built into the business’s operating costs.

key tax deductions for your small business

You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. Whether you’re running your business as a side hustle or it’s a full-time commitment, you’ll get to a point where you will want to take some of the revenue for yourself. The best way to do this is to pay yourself https://kelleysbookkeeping.com/ a «salary» – there are different ways to do this. Banking services are provided by Piermont Bank, Member FDIC. Credit and debit card services are provided by Evolve Bank & Trust, Member FDIC. The downside, however, is that your salary is extremely rigid. The IRS has a ‘reasonable compensation’ rule which states that your salary must be in line with others in your industry.

However, if the earnings are less, you need to have a clear understanding of your priorities in personal life and in business. Therefore, you need to check with the department of labour as to under what payroll schedule falls. Instead, each partner has a share in the earnings generated based on the percentage of share stated in the partnership agreement. Accordingly, you are also not subject to pay any self-employment taxes. Typically, an individual is considered an independent contractor where the recipient of services or the payer controls or directs only the result of the work. Such a person does not guide on what work needs to be done and how.

How Much Should I Pay Myself As a Business Owner?

This allows them to receive a steady income and also take funds from the business when needed. With a combination approach, it’s important you manage funds carefully to ensure enough working capital is left in the business to operate. The funds drawn out of the business must be taken out of the business profits after paying all the business expenses. In this article, we will discuss how to pay yourself as a business owner, that is, pay yourself from a sole proprietorship, partnership, and Limited Liability Company .

- If this scenario rings true to you, consider a different approach.

- Additionally, business owners should consider their lifestyles and other expenses, such as vacations and entertainment.

- Information provided on Forbes Advisor is for educational purposes only.

- Another way of contributing towards your retirement plan is through Registered Retirement Savings Plan .

However, the owners of a corporation who are engaged in its day to day operations, need to pay themselves as salary. Keeping small portions of all possible options in your portfolio is always a tactful decision to maintain a good balance. Most business owners keep a mix of both salaries and dividends to pay themselves. While salary gives you a monthly assured earning, dividends provide extra earnings for increased personal expenses.